STNL vs. Treasuries: Why Single-Tenant Net Lease Investments Win in a Volatile Rate Era

Single-tenant net lease (STNL) assets deliver stable, superior returns even as Treasury yields and market volatility rise. Our 10-year comparison shows STNL remains a reliable choice for investors seeking portfolio safety and consistent income in today’s evolving landscape.

05. November 2025

7 min. read

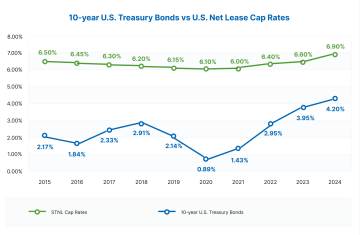

Over the past decade, U.S. 10-year Treasury yields and single-tenant net lease (STNL) cap rates have displayed strong correlation—yet with notable spread compression in recent years as Treasury rates surged and cap rates stabilized near cycle highs. The risk premium in net lease real estate has been historically attractive, yielding a consistent spread above risk-free returns, but in 2023-2025 that difference has narrowed. Still, STNL assets offer distinct, enduring advantages for long-term investors.

Stability Amid Volatility

Despite recent upward pressure on borrowing costs, STNL cap rates have remained relatively steady, now averaging just above 6.9% nationally. This stability has been vital as treasury yields reached multi-year highs above 4% following Fed tightening and global economic uncertainty. While market volatility caused price adjustments and transaction volume fluctuations, high-quality STNL assets—especially industrial, medical, retail, and essential service properties—continued to attract considerable capital.

Why Invest in STNL Today?

- Predictable Cash Flow: Long-term net leases (often backed by investment-grade tenants) provide stable, bond-like rental payments and shelter owners from operating expense volatility, making STNL one of the most reliable cash flow generators in CRE.

- Reduced Management Burden: Tenants are responsible for property expenses (NNN structure), minimizing the investor’s day-to-day involvement.

- Attractive Risk-Adjusted Returns: With cap rates remaining comfortably above Treasury yields, STNL investments can deliver superior risk-adjusted returns even as interest rate spreads begin to compress.

- Portfolio Diversification: The unique structure and lease stability of STNL enables investors to diversify both by tenant industry and geography, lowering risk across the portfolio.

- Inflation Hedge: Many leases include annual rent escalations or CPI increases, helping maintain real returns when inflation rises.

Outlook and Strategic Implications

- Current trends point to sustained demand for competitive, lower-risk STNL properties as an alternative to traditional CRE and fixed income assets.

- Yield compression between Treasuries and CRE means careful underwriting is key, with priority on tenant credit, lease length, and underlying asset quality.

- Investors seeking to hedge interest rate volatility, secure stable income, and achieve steady appreciation are finding STNL increasingly favorable in the “higher-for-longer” rate landscape.

Final Takeaway

For those seeking to balance stability and yield, STNL investments offer a reliable path for portfolio growth against a challenging macro backdrop. Rigorous asset selection—and focus on credit quality—remains essential, but the fundamentals supporting STNL are stronger than ever.

Sources: Oxford Economics and Trade Net Lease, 2025.

Share