Strategy

Reliable, long-term income with select value add potential.

Our strategy is to build a bridge between patient Swiss and European capital, seeking access to a new international market and real estate asset class, together with achieving consistent, secure long-term cashflow driven returns, and in doing so, build a significant U.S. real estate platform.

In assembling our portfolio, we aim to be a counterparty of choice and to become known as an asset‑class specialist in the U.S. long-term, triple-net single occupier market, and to achieve a granular portfolio of triple-net lease commercial properties across selected U.S. states.

We proactively seek out high quality credit rated or publicly listed tenants, operating in stable and resilient industry sectors, positioned in strategic locations, and where the surrounding demographics support the continued operations and future residual land-use potential.

Actively managing our portfolio to progressively unlock the upside potential of each property via either repositioning, expansion or redevelopment, our differentiated strategy shall then see our interacting with the European debt and equity markets to accelerate our long-term vision and growth of our portfolio.

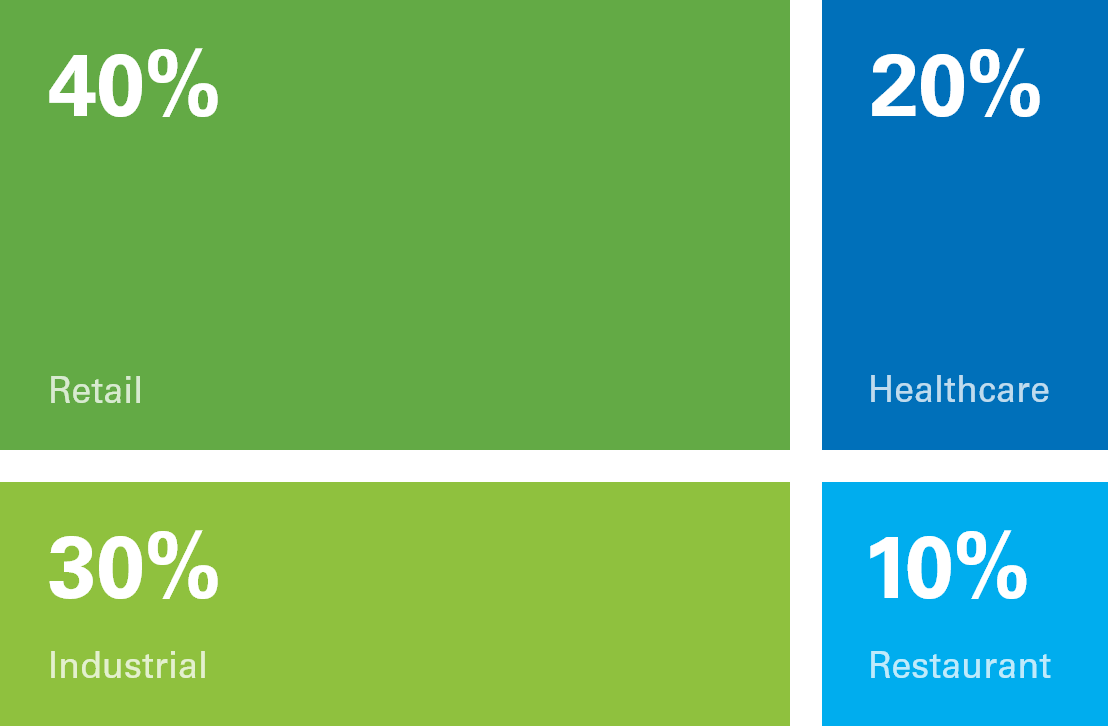

Target Industry Diversification

Our targeted property types span industrial, last mile logistics, healthcare, restaurant, essential retail and cold storage.

As we assemble our portfolio, we seek not only tenant industry diversification, but also geographical (state and metro-area), tenant and asset class diversification to mitigate against financial, occupancy, climate change and macro trends risk.

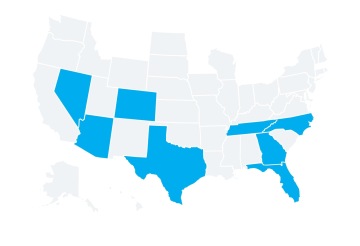

Target Geographies

In accordance with our investment criteria our target geographies have been selected based on a combination of current migratory trends, adversion to climate risk, and the growth of different state economies and as otherwise opportunistically-led by prospective acquisitions.

Our senior management

co-invest in each of our transactions to ensure alignment.

As a key founding principle of Unity, our senior management are significant co-investors in each and every transaction we do to ensure unbiased decision making and a proper alignment of risk sharing.

Co-investing along-side our investment partners is an essential component of our business model, and is a true differentiator to typical externally managed situations, ensuring conflicts of interests never arise, while building trust that all acquisitions are robustly screened and then diligently managed.

Acquisition Professionals

Please feel free to contact our acquisition professionals for an open discussion about any potential purchase opportunities.

Christopher Millen

CIO

By proposing a prospective acquisition to us, you hereby agree to our Website Terms of Use and in particular, the provisions relating to the submission of a property.