Our difference, a platform for Swiss capital

Alternative investment into unlisted direct U.S. commercial real estate via our uniquely structured platform provides a low risk portfolio balancing solution.

13. February 2023

6 min. read

In Search of Dividend Yield

Alternative investment into unlisted direct U.S. commercial real estate via our uniquely structured platform provides a low risk portfolio balancing solution, uncorrelated with listed shares or other more volatile asset classes, is a natural hedge against inflation given the indexed nature of the long term leases we seek out, and which via manager share buy-back windows, still offers liquidity.

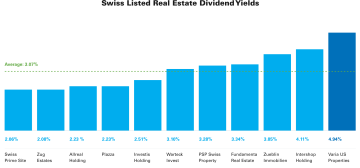

According to Q1 2023 listed equities research from leading Swiss investment bank UBS, the average dividend yield for 2022 for the top eleven Swiss listed real estate stocks was 3.07%.

As can be seen from graph below, Varia US Properties AG (being the only other Swiss firm which invests in the U.S., but specifically only in the multi-family residential housing sector), was a standout at 4.94% p.a.

In contrast, the dividend yield for our flagship vehicle Unity Real Estate AG (“URE”) is forecast at a (pre-tax) 6.50% p.a., providing a compelling 150bp premium, while also providing important asset class diversification via our own sector vertical specialisation of long-term (8 year+ WAULT), triple net lease (NNN) properties, occupied by leading US and international credit rated tenants.

Total Shareholder Returns

Importantly however, URE in addition to its forecast sustainable dividend yield, also provides scope for double-digit total shareholder returns (TSR) via the long-term residual value potential of each of the properties we acquire that we intend to unlock through tactical asset management.

According to UBS, the Swiss listed real estate sector over a 5 year look-back period from Y/E 2017 - 2022 has delivered an averaged TSR of only 4.40%.

About our vehicle: Unity Real Estate

Unity Real Estate AG (“URE”) is our group’s flagship investment vehicle investing exclusively in U.S. NNN, long-term leased, standalone commercial properties subject to periodic indexation.

Incorporated in Stans, Nidwalden, URE is exclusively advised in Switzerland by Unity Capital Partners AG (“UCP”) with our portfolio actively managed on the ground in the U.S. via UCP’s related entity; Unity Capital Partners (U.S.) LLC.

Source: Unity Capital Partners AG and UBS Group AG - Research.

Share