Stable regular indexed returns with additional upside

Triple-net (NNN) leased properties have some district advantages over treasury notes and bonds and without the same correlation and price fluctuation risk, when searching for sustainable yield.

12. February 2023

10 min. read

While commercial properties leased to investment grade, (typically single tenants) under triple-net lease structures have their predictable cashflows often compared to Treasury notes, fixed income securities, debt products or corporate bonds, a notable difference is that unlisted direct alternative investment into NNN leases is not exposed to the same market fluctuations and yield volatility, especially in recent times during the COVID-19 pandemic.

They also both lack one fundamental aspect: The chance for investors to realise additional capital gain above their regular yield, via the unlocking of each property's long-term, highest and best use potential and the residual value of the land.

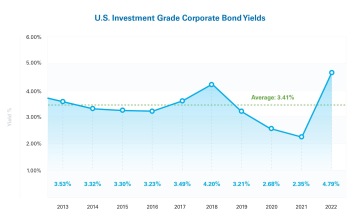

As can be seen from the below graphs, both U.S treasury yields and investment grade corporate bonds are susceptible to significant fluctuation, and over a 10-year historic period from 2013 - 2022, have respectively provided investors an averaged 2.08% and 3.41% return p.a.

The relationship of fixed income to NNN leases

In the fixed income market, yield to maturity is used to measure a bond’s unlevered annualized return and while bond yields reflect various macroeconomic and capital market factors such as the interest rate environment and yields on competing investments, issuer credit quality is the fundamental risk characteristic that drives bond pricing. Thus, bonds issued by investment grade rated companies trade at lower yields than bonds issued by non-investment grade issuers.

Similarly, in the commercial real estate market, investors use capitalization rates to measure the unlevered annual return (or expected yield) on an investment. Thus, cap rates may be understood as analogs for bond yields.

Like bond yields, cap rates generally move higher or lower depending on the risk profile of the property.

While a bond’s risk is primarily centralized around issuer credit quality, it is much the same for NNN properties, where a primary factor is tenant default risk followed by real estate risk (i.e. Location risk, re-leasing risk, asset age and obsolescence, competition etc).

Accordingly, provided the asset manager is astute in mitigating real estate level risk via careful asset selection in the first instance, net leased properties provide a cash flow profile similar to investment grade fixed income investments.

Some of the advantages of triple net leased assets

While fixed-income investments and net lease real estate feature many similarities, there are however key differences for investors to be cognisant of.

Firstly, as a rule, the investments we make at Unity all feature annual (or otherwise structured) rental escalations during the lease period (providing a hedge against inflation through consistent income growth throughout the lease term), in contrast to bond coupon payments which are fixed until maturity.

For example, a 10-year bond that yields 4.00% will still yield 4.00% in year 10 since coupon payments are fixed over the life of the bond. In contrast, a 10-year NNN property purchased and sold at the same cap rate (e.g. 5.75%), but with 2.00% annual rental escalations will yield 6.87% in year 10.

Face value erosion due to inflation

Important to note is that the bond’s coupon payments lose relative value over time (taking into account inflation), while the rent received from the NNN property grows throughout the investment period. For a worked example, please refer to our related insight, 'Making the case for NNN leased properties over corporate bonds'.

Secondly, when a landlord leases a property, the tenant agrees to either renew the lease or return the asset at lease expiration. When a corporation issues bonds, they agree to return the principal at face value to investors at maturity. The difference between these repayment methods offers an additional potential hedge against inflation. Whereas the bond’s repayment figure at maturity is fixed, the real estate asset offers the potential for appreciation or yield growth at lease maturity, not to mention alternative use or development potential to really bolster returns.

The superiority of NNN leased properties when it comes to recovery rates

From 1987 to 2018, the historical recovery rate for senior unsecured bonds was 48% (Source: Moody’s 2019 Default Research Study). In contrast, a newly constructed, well located net leased property should, if managed well managed and carefully selected in the first instance, have a recovery rate of 100% via tenant retention (extension), re-leasing or redevelopment.

Addressing the illiquidity argument

While unlisted NNN real estate is indeed less liquid than the daily trading seen in the bond market (given the time it generally takes to dispose of a property to realise capital gain or a return of principal), a prudent manager of direct real estate can nevertheless provide investment partners limited liquidity options via refinancing measures without the need to physically dispose of a property, or to offer limited share buy-back windows.

Liquidity risk may partially explain why net lease assets have traded at higher yields relative to fixed-income investments despite the underlying cash flow profiles being relatively similar in nature, but for investors with a longer-term investment horizon not so concerned with daily liquidity, most prefer the opportunity to obtain higher yield.

Source: Real Capital Analytics, MSCI

Share