Making the case for NNN leased properties over corporate bonds

Triple-net leases (NNN) offer superior characteristics and return levels over corporate bonds and being commercial real estate backed, provide an important means of asset-class diversification in a well-balanced portfolio.

03. March 2023

8 min. read

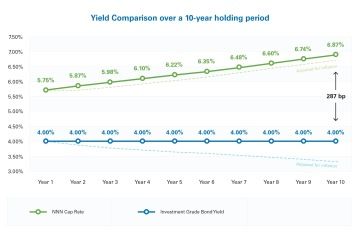

In making the financial case for triple net lease (NNN) properties over investment grade bonds, the below table (using an assumed purchase price of USD 1'000) shows how, over a 10 year measurement period, the yield on an investment-grade corporate bond which remains fixed at 4.00% p.a. significantly lags behind the annual yield from a triple net lease property whose lease is subject to annual indexation increases of 2.00% p.a.

As can been seen in Year 10, the investor in the NNN property enjoys an unleveraged yield of 6.87% by year 10, compared to the bond which is still providing the flat 4.00% annual return (and which has been eroded by inflation). Equating an averaged yield premium of 230bp.

Yield comparison on an unlevered versus levered basis

The graph below serves to illustrate at a glance, the point made above to showcase the positive yield spread NNN leased properties can offer of a non-indexed corporate bond.

The Leverage Effect

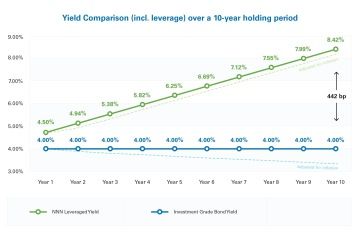

However, a key difference between a corporate bond and a real estate backed security is the simple fact that commercial real estate is almost always leveraged via senior debt which amplifies equity returns.

Accordingly, assuming a senior loan with a conservative loan to value ('LTV') ratio of 50.00% (allowing a USD 1'000 investment to purchase a property with a gross asset value of US 2'000) amortising its principal at 3.00% p.a. and with an interest cost of 4.00% p.a. (for a total debt service of 7.00% p.a.), it can be easily seen in the table below, that such yield spread significantly increases to an average 442 bp p.a., which notably, still excludes the potential for further gains via the underlying value of the property which the investor still owns a share in, versus the flat repayment of a bond's initial investment at maturity.

The graph below illustrates the point made above to showcase the even more pronounced yield premium which NNN properties, with leverage conservatively applied, can offer of a non-indexed corporate bond.

The additional capital gain of a NNN property over bonds

In the graph below, to model the potential additional capital return which NNN properties can provide over bonds, we assume that a property which has been leveraged, is sold at the end of year 10, with moderate cap rate compression of 50 basis points over the hold period (i.e. having assumed an entry cap rate of 5.75%, we assume an exit cap rate of 5.25%).

Superior IRR

Taking into account the Net Operating Income ("NOI") of the property in Year 10 (which has grown during the hold period due to annual indexation having been applied on a compound basis), and applying the above exit cap rate, results in a gross sale price (before transaction costs) of $2'618 which after repayment of the amortised loan principal, gives a levered Internal Rate of Return ("IRR") (or otherwise known as total return during the hold period) of approximately 12.81% p.a. compared to the bond’s unlevered IRR of 4.55%.

No Pricing Volatility

Lastly, an additional benefit of NNN properties over bonds is the absence of pricing volatility compared to the often erratic listed bond market. For further information, read here: Stable regular indexed returns with additional upside.

Source: Unity Capital Partners AG. March 2023.

Share